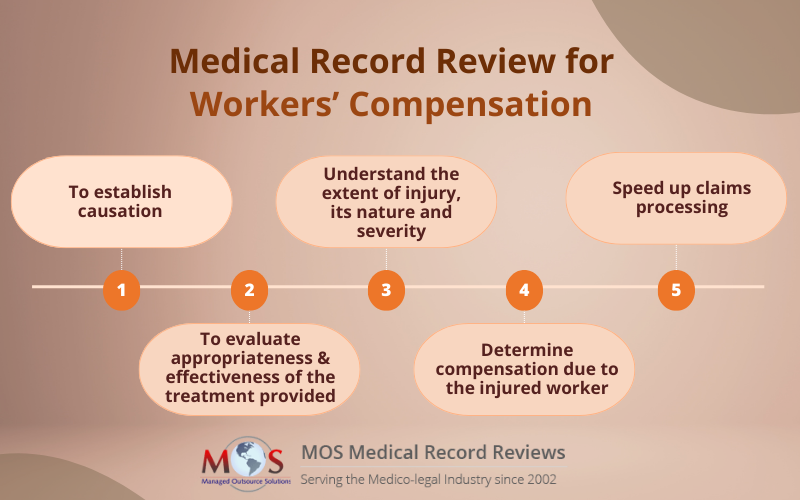

Workers’ compensation benefits are available for employees who have been hurt on the job through no fault of their own. Employers and insurers need to ensure that the workers’ compensation claims filed are genuine and for this they scrutinize each claim fastidiously. Chart review is an important part of the scrutiny. To ensure accuracy and speedy review of the claimant’s medical records, insurance attorneys utilize medical review solutions. The medical records provide evidence of the injury or illness for which compensation is claimed, which helps ensure the legitimacy of the claim.

MOS Medical Record Reviews provides the best chart review services.

Contact us today to discuss a customized solution.

Here are some common questions regarding workers’ compensation insurance.

- How does workers’ compensation insurance work?

Designed to protect employees as well as employers if a work-related injury occurs, workers’ compensation pays medical expenses and cash benefits for injured or ill employees. The injury or illness must be as a direct result of their job or the workplace environment. It is important that the injured or ill worker notifies the employer about the injury/illness as soon as possible. They should seek medical care straightaway and follow the physician’s orders carefully.

- Is workers’ compensation mandatory/required by law?

Most U.S states require employers to have workers’ compensation as soon as they hire their first employee. However, each state has its own regulations related to workers’ compensation. Texas is the only state where it is optional for employers to purchase workers’ comp insurance. Also, the construction industry has separate rules compared to other industries.

- Do employees have to pay into workers’ compensation insurance?

No. Employees don’t have to pay into this insurance. Moreover, there isn’t any particular time requirement to become eligible for the benefits. From the time a person becomes an employee, he/she is entitled to workers’ compensation if a work-related illness or injury occurs. The employee will not, however, be eligible if

- He/she purposefully injured himself or herself

- The injury is the result of the worker being intoxicated from alcohol or drugs

- What should an employee do if he/she is injured or taken ill while on the job?

- Report the injury to the supervisor/employer immediately

- Request to see a doctor

- Request and complete a workers’ compensation claim form

Only when the employee reports the injury and the claim form is returned to the employer, the employer is obliged to provide the injured worker with benefits.

- What benefits will the injured employee receive?

- Medical care: The insurance company will cover the bills for all reasonable treatments received by the employee

- Disability payments: If the employee is not able to work temporarily, these are paid as a partial compensation for lost wages.

- Permanent disability settlement: If the injury leads to permanent disability or restrictions, compensation is paid based on the seriousness of the disability.

- Vocational rehabilitation: This involves paid training in new employment in case the employee cannot return to his/her earlier job, and if the company doesn’t have an alternative or modified work the employee can perform.

- Does an injured employee have to receive medical treatment from the company doctor?

Whether an employee must receive treatment from the company doctor, and for how long will depend on each state. Some states allow the employee to use the company doctor for the first month of treatment, and then they have the option to select their own doctor for further treatment. Also, employees who are not happy with their company doctor may be able to change their doctor. Some states allow employees the right to select a doctor in advance for treating any work-related injury or illness.

- Who pays the workers’ compensation benefits?

The employer’s insurance company pays the benefits. The claims are handled by an insurance adjuster from the insurance company.

- Where can an employer purchase workers’ compensation insurance?

Employers can buy this insurance from either a licensed insurance company or through their State Fund. Or, employers can choose to self-insure for workers’ compensation. For this, they must obtain state approval and meet individual state requirements as regards net worth, net income per year, and a certain security deposit.

- How are workers’ compensation premiums for employers determined?

The annual premium employers must pay their insurance company is calculated based on may factors such as industry classification, the company’s past history of work-related injuries, payroll, special group or dividend programs the company may be eligible for, and so on.

- Can an employee who is on workers’ compensation be fired?

Employers cannot discriminate against a temporarily disabled employee who is on workers’ compensation by terminating his/her services or laying them off. There are 2 exceptions to this rule, and employers can terminate or lay off an employee,- If a medical chart review finds that the employee is unable to return to his or her usual occupation

- If the employer needs to find a substitute employee because of business necessity

- What is employer’s liability insurance?

The employer’s workers’ compensation insurance includes employer’s liability insurance, provided you didn’t purchase it from a dominant state fund. If it has been purchased from a state fund, employers can add this insurance as an endorsement from a private insurer.

- Is workers’ compensation mandatory for independent contractors and self-employed people?

Typically, independent contractors need not purchase workers’ compensation insurance. However, these categories of employers may require workers’ compensation

- If the business they perform/ work for requires them to purchase it.

- To ensure coverage for work-related illnesses or injuries that are not covered by their health insurance.

- To replace wages lost during recovery following an injury or illness.

- Does worker classification matter?

Yes, because workers’ compensation costs partly depend on the type of work done by the employees. Therefore, employers must make sure that their employees are classified properly. This will help avoid lawsuits and penalties. Every worker must be given a workers’ compensation class code to correctly signify their work environment and level of risk.

- What is the difference between workers’ compensation and general liability insurance?

Both these insurances can pay for medical expenses related to the injury or illness sustained by a worker at the workplace. General liability does not cover employee injuries. To extend the protection to employees, employers must purchase workers’ comp insurance that covers medical costs related to employee injuries and illnesses.

- What can an employer do if they find that a workers’ compensation claim is not valid?

The matter must be reported to the employer’s workers’ comp claims administrator. Provide them with information regarding all the known facts of the claim, witnesses, and people whom they can talk to.

We assist workers’ compensation attorneys with dedicated medical record review services.