Medical records contain important details such as a patient’s medical history, diagnoses, and treatments. These records are difficult to understand because of their complexity and the use of medical jargon. Moreover, these are voluminous, which necessitates the preparation of accurate medical record summaries. Insurance claims medical record review summaries provide insurers with a concise and organized overview of a patient’s medical history, diagnoses, and treatments. Medical record review allows insurers to determine the extent of the injury or illness and the associated costs. It also ensures that insurers are only paying for those expenses that are directly related to the treatment done.

Ensuring a fair claim settlement in medical litigation requires error-free medical review services. At professional medical record review companies, summaries are prepared by professionals, such as medical coders, clinical reviewers, legal nurse consultants, underwriters or attorneys, who are familiar with the medical record terminologies.

Let us check how such medical record summaries are useful in claims processing and why they are indispensable for insurance companies.

Speed up claims processing with professional medical review services!

How Are Medical Record Summaries Prepared?

Medical record summaries are prepared by professionals, such as medical coders or clinical reviewers. Let us look at the steps involved in the preparation of a medical record summary:

- Data Extraction: Relevant information from the patient’s medical records is identified and extracted. This includes diagnoses, treatments, surgeries, medications, and any other pertinent details.

- Summarization: The extracted data is organized into a concise and structured format, following specific guidelines.

- Quality Assurance: Summaries undergo rigorous quality checks to ensure accuracy and completeness.

- Delivery: The final medical record summary is provided to the insurance company, where it becomes an integral part of the claims processing workflow.

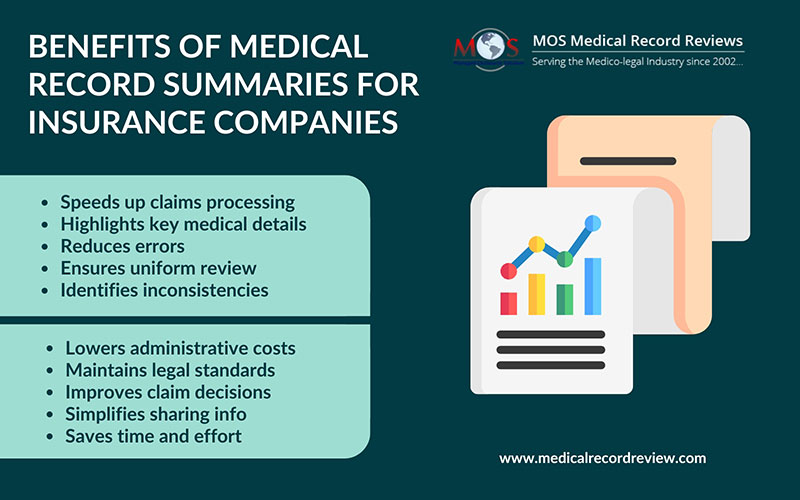

Reasons Why Insurance Companies Need Medical Record Summaries for Claims Processing

Insurance companies use medical abstracts for claims processing for several key reasons such as:

- Efficiency and speed: Medical case summaries shorten extensive and complex medical histories into concise data. This allows claims processors to quickly review the necessary details without spending excessive time on lengthy records, thereby speeding up the claims processing time.

- Clarity and focus: Summaries highlight the most critical aspects of the medical records, such as diagnoses, treatments, procedures, and outcomes. This helps claims processors focus on the most relevant information needed to make informed decisions about claims.

- Accuracy: Well-prepared summaries ensure that all relevant medical information is accurately captured and presented. This reduces the risk of errors and omissions that could potentially lead to incorrect claim approvals or denials.

- Consistency: Standardized summaries provide a uniform format for reviewing medical information. This consistency helps claims processors evaluate and compare cases systematically, leading to more reliable and fair decisions.

- Simplified decision-making: With key information readily accessible, claims processors can make quicker and more informed decisions regarding the validity and coverage of a claim. This can enhance the overall efficiency of the claims process.

- Fraud detection: Summaries can help identify inconsistencies or anomalies in a patient’s treatment history, making it easier to spot potential fraud. By summarizing and highlighting key medical details, unusual patterns or inconsistencies can be more easily detected.

- Compliance: Review of medical records helps ensure that claims processing adheres to legal and regulatory requirements. By clearly documenting all relevant medical information and justifications for treatments, insurance companies can maintain compliance with healthcare regulations and standards.

- Improved communication: Summaries provide a clear and concise way to communicate medical information to other stakeholders, such as insurance adjusters, legal teams, and healthcare providers. This facilitates better collaboration and understanding among all parties involved in the claims process.

Overall, medical record summaries are a valuable tool for insurance companies, enhancing the efficiency, accuracy, and fairness of the claims processing system. Choosing the right medical record review company is crucial to ensure error-free reviews.

Ensure accuracy and efficiency!

Get started with our medical record reviews now!