The largest “retirement plan” in the United States, social security retirement program is a great source of income for all Americans. Apart from retirement benefits, the SSA (Social Security Administration) provides disability benefits to disabled Americans who cannot work and earn a living. SSDI or Social Security Disability Benefits are determined on the basis of a medical record review, which makes medical record review for attorneys an important service for disability lawyers. Social security attorneys can assist people planning to retire as well as those applying for disability benefits.

Before you sign up for benefits, make sure to consider the following.

Calculate your full retirement age (FRA)

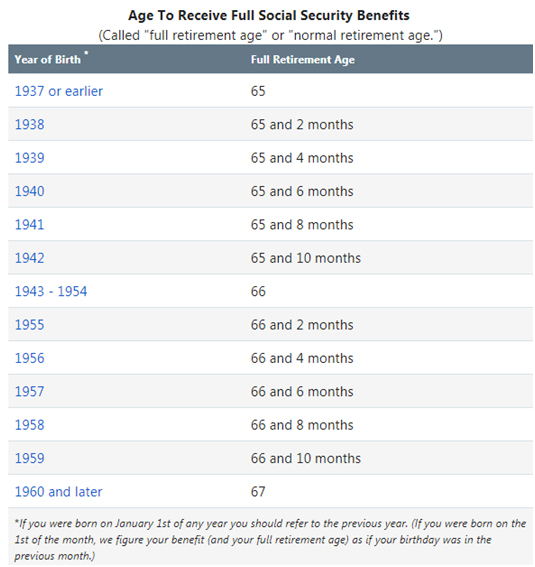

Before signing up for Social Security benefits, know your full retirement age (FRA). FRA will be calculated based on the year you were born and is not the same for everyone. Currently, the full benefit age is 66 years and 2 months for people born in 1955, and it will gradually rise to 67 for those born in 1960 or later. A 2017 Fidelity survey highlights that only 26% of respondents could correctly identify their full retirement age for Social Security purposes.

By filing for benefits before full retirement age, you’ll face a reduction in the monthly payments you collect. Your 35 highest years of earnings on record are taken into account when calculating your full monthly benefit. You should reach your full retirement age(FRA), to be eligible to receive 100% of your monthly benefits.

SSA’s handy table can be used to locate your precise full retirement age.

Source – https://www.ssa.gov/planners/retire/retirechart.html

Benefits for spouse

Before claiming, make sure to know both your benefit and your spouse’s benefit. Spousal benefits are designed to provide retirement income to spouses who either didn’t work, or earned much less than their spouses over their working lifetime.

Just like standard Social Security retirement benefits, your spousal benefit can be permanently reduced if you claim it before your FRA. Also, if you claim at age 62, your spousal benefit can be permanently reduced by 35%. Consider this when deciding the best age to claim your benefit. To determine eligibility for a spousal benefit, your retirement benefit is calculated first.

When to file – early or late

You can either start collecting Social Security as early as age 62 or as late as age 70.Even if you’ll get your money sooner while applying for benefits before FRA, your monthly payments will be reduced by a certain percentage depending on how early you file. Based on an article in Market Watch, more than half apply for these claims before they reach full retirement age, while more than 30% apply as soon as they can – at age 62. Only about one in 25 applicants waits until age 70, when they will get maximum monthly benefits.

If you delay your benefits past full retirement age, you’ll accumulate credits for each year. This will boost your benefits by 8% up until age 70, at which point that incentive runs out. But do not delay after 70, as this incentive runs out at that age. Remember that if you decide to file at full retirement age and quit your job simultaneously, it will hurt you financially.

Learn about taxes

Based on your total income, up to 85% of your Social Security benefits could be subject to federal income tax. Whether you should pay tax on your SSD benefits or not depends on your combined income – your adjusted gross income (AGI) + any nontaxable interest income and half of your Social Security benefits. In most cases, you probably won’t pay taxes on your benefits if Social Security is your only source of income. But, if you earn better income from a job or your own business, you’ll have to pay tax on at least part of your retirement benefits. Before you apply for benefits check whether it is taxable or not.

Keep documents ready

The Social Security Administration (SSA) requires certain key documents to show that you are eligible for the claim such as –

- Social Security card (or a record of your number);

- Original birth certificate or other proof of birth (You may also submit a copy of your birth certificate certified by the issuing agency);

- Proof of U.S. citizenship or lawful alien status if you were not born in the U.S. (more info);

- A copy of your U.S. military service paper(s) (e.g., DD-214 – Certificate of Release or Discharge from Active Duty) if you had military service before 1968; and

- A copy of your W-2 form(s) and/or self-employment tax return for last year

Even if any documents are missing, you can sign up for Social Security and provide the missing documents later on. For those claiming disability benefits, relevant medical documentation should be produced for review. Legal representation would prove beneficial for disability applicants. Medical review companies assist disability attorneys in organizing and summarizing all the medical records that support the disability claim.