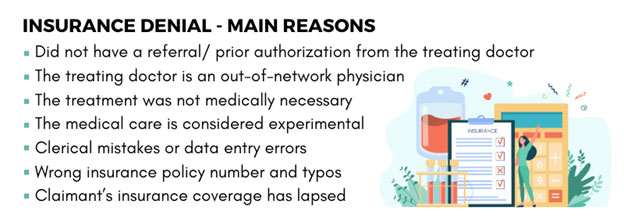

Insurance denials are not something new and specific reasons for denials will be outlined in the EOB or the Explanation of Benefits document the insurer sends to the claimant. It helps prevent insurance fraud and control escalating healthcare costs. Insurance payers and lawyers can rely on medical peer review services to improve their decision making when it comes to resolving complex billing and medical utilization disputes.

3 Distinct Level Insurance Denial Appeals Process

1st level appeal

- The claimant and doctor contacts the insurer

- A request is placed to reconsider the denial

- The doctor may request to talk to the insurance peer review physician

2nd level appeal

- The appeal is reviewed by the insurer’s medical director who was not involved in making the claims decision.

- This appeal is intended to prove that the request should be accepted within the coverage guidelines

Independent external review

- Insurer’s independent reviewer and a doctor belonging to the specific medical specialty evaluate the appeal

- They determine whether to approve or deny the claim

- External review is requested if an internal appeal fails

To reduce insurance denials, it is important for the policy holders to have a clear understanding of the guidelines and any updates provided by the insurance companies.