Telemedicine has been evolving as a popular healthcare alternative, especially for people living in remote locations without immediate access to a healthcare provider. Now, with the social distancing necessitated by the COVID-19 epidemic, the relevance of telehealth and telemedicine has increased considerably. Health plans can expect to see a surge in claims related to telemedicine/telehealth services. This would in turn result in increased demand for medical review services on the part of workers’ compensation attorneys and insurers to manage the claims in a timely and efficient manner.

Gain Easy Access To Vital Medical Facts!

Customized medical review services for your unique case evaluation needs.

Many employers have already been using telemedicine solutions including virtual appointments to provide care for their employees. These services have been increasingly used in the workers’ compensation system to treat injured or ill workers amid COVID-19 shutdowns, and are still being used owing to their convenience. Telemedicine is useful in that physicians and other clinicians can decide on the care each patient requires, recommend follow-up treatments, and identify complications that may need further investigation. This would speed up employee recovery and enable them to return to work at the earliest.

Many Advantages

Though telemedicine is not a solution for all kinds of healthcare conditions, there are many less serious concerns that can be handled well via a virtual consultation. Now, providers even offer virtual physical therapy services. The greatest advantage of telemedicine services is that patients don’t have to travel to meet their physicians. However, it is important that providers have an open conversation with their patients, outlining the merits as well as shortcomings of telehealth services. Patients should have a clear understanding of what they can expect from the telemedicine care so that they will maintain realistic expectations. Telemedicine visits are usually conducted over a mobile device such as a cellphone or tablet, or via a desktop computer.

Advantages include:

- A convenient option for workers who need care for minor injuries, after-hour visits, and follow-up consultations, especially in times like the current health emergency or a natural disaster

- Shorter wait times

- Flexible scheduling for appointments

- Choose the best doctors in a broad geographical area

- Saves travel time, parking and other expenses for workers

- Reduce the amount of time away from work

- Workers on the move such as truckers, salesmen and others can access treatment irrespective of their location

- More efficient consultation

- Better chance for real-time monitoring of patients with chronic illnesses since they can communicate with their provider regularly

- Remote patients can have access to specialists and benefit from immediate medical evaluation and treatment recommendation

- Injured workers can benefit from early evaluations and the care required can be triaged appropriately. This early assessment enables employers to support care management and also start internal protocols at the earliest.

- Telemedicine consults can speed up the worker’s return to his/her job

False Telemedicine Claims Could Be a Major Concern

When the workers’ compensation system utilizes telemedicine as an efficient treatment alternative for injured or ill workers, there is bound to be a great increase in the number of insurance and workers’ compensation claims. Alongside, insurers can expect to see a number of fraudulent claims submitted by unethical individuals. Whether workers’ compensation, auto, or health – insurers are vulnerable in that they are going to receive large volume medical claims to review and determine reimbursement. Bogus claims are very likely going to focus on diagnostic exams, tests, and treatments that don’t need direct physical contact between the patient and provider. So, what is the risk involved for insurers?

Insurers may fail to identify falsely used medical billing codes, being unfamiliar with telemedicine and its various codes. According to James Quiggle, senior director of communications for the Coalition Against Insurance Fraud, a new flood of tele-scams could very well be the U.S’ next large surge of medical fraud. He says that large crime rings could profit considerably from telemedicine. As he points out, “telemarketing firms can hire phone boiler rooms to tele-recruit hundreds of bogus patients. The patients are referred to colluding providers for bogus tele-consults and treatment.” Moreover, tele-pharmacies could take fraud prescriptions for expensive and unnecessary compound medications or painkillers. Everyone involved in the scam would benefit from kickbacks and inflated claims. Fraudsters could exploit conditions such as soft tissue injuries, for instance, whiplash. If workers’ compensation insurers are not watchful, fraudsters could exploit the system by presenting claims for medically unnecessary, inflated treatments or even for treatments that were never provided.

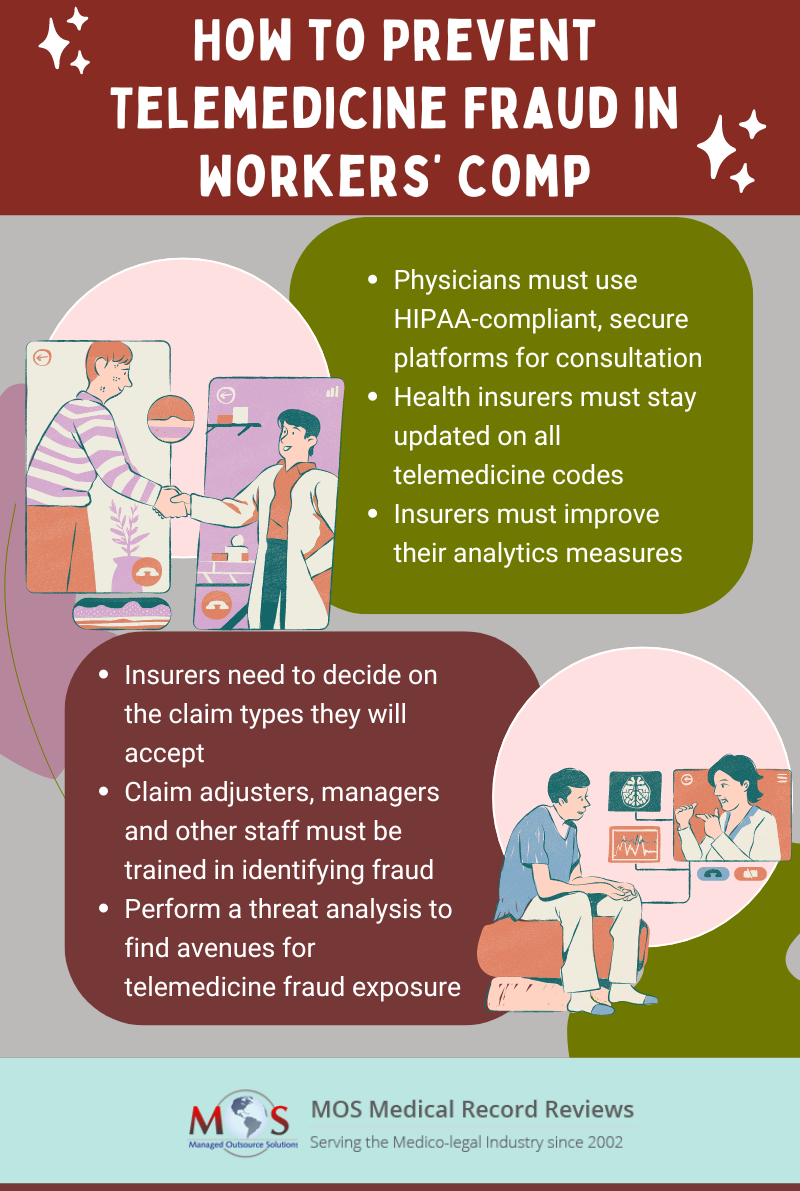

Measures to Take to Prevent Telemedicine Fraud

- Physicians providing telemedicine consults must ensure that the platform they use is HIPAA-compliant and secure. They must also follow all state laws related to recording calls and conversations. This will ensure that patient information is protected and doesn’t fall into the hands of scammers.

- Health insurers must take effort to know the actual codes relevant for telemedicine because only then can false claims be identified. They should be knowledgeable of the rules, regulations and laws pertinent to each state.

- Insurers must improve their analytics measures to identify suspicious telemedicine billings.

- Insurers must also decide on the types of claims they will accept, the cost, severity, and frequency.

- Provide training for staff, whether claims adjusters, managers or special investigative units, to identify possible fraud schemes.

- Conduct a threat analysis to spot any avenues for tele-fraud exposure.

Medical Claim Review Can Help Identify Fraud

Medical claim review, which is a major medical review service, is an effective way to ensure accurate medical billing and identify fraudulent billing. Claim review professionals employed by a medical review company are trained and knowledgeable in the valid code combinations applicable to telemedicine services. They will ensure that the submitted claims are coded appropriately in keeping with industry standard coding guidelines such as American Medical Association (AMA), Current Procedural Terminology (CPT), CPT Assistant, HCPCS (Healthcare Common Procedure Coding System), ICD-10-CM and PCS, NDC (National Drug Codes), Uniform Billing (UB) Editor, Diagnosis Related Group (DRG) guidelines, CMS (Centers of Medicare and Medicaid Services) National Correct Coding Initiative (NCCI) Policy Manual, CCI table edits and other CMS guidelines. Benefit coverage, medical policies, clinical payment and coding policies, provider contract language – all come within the purview of claim review. If any anomaly is identified, providers can be requested to submit additional documentation.

Professional Medical Chart Review To Identify Fraudulent Claims

Ask us for a Free Trial!

Once people get used to the convenience offered by telemedicine, most of them will prefer it above going to the doctor’s office. So, there is no doubt that health insurers will have to provide coverage for telemedicine services to attract patients. It also follows that providers of medical review services will have to stay abreast with all applicable telemedicine-related medical codes.