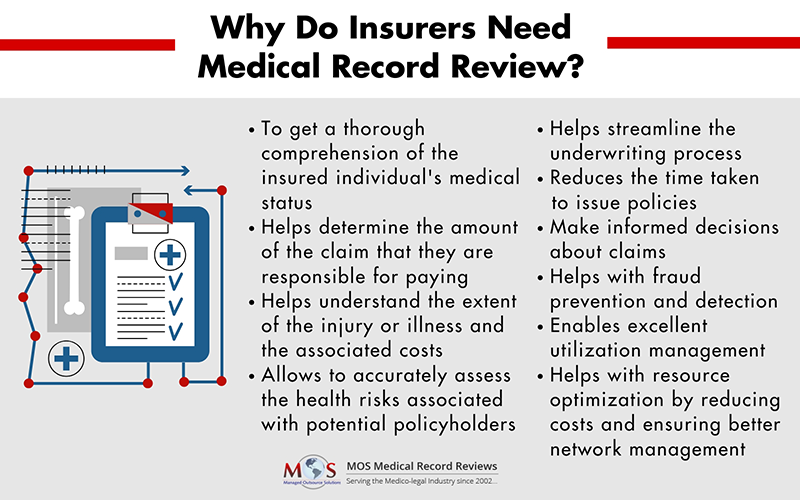

Insurance companies deal with diverse claims including personal injury, mass tort, medical malpractice, product liability, and workers’ compensation claims. Insurers often pay only for those expenses that are directly related to the injury or illness. Medical record review involves the examination and summarization of medical records to extract pertinent medical information. Reviewing medical records for Insurance play a crucial role in claims processing, as it provides insurers with essential information to assess the extent of their responsibility in covering claims. Insurance providers are obligated to cover medical expenses arising from the insured individuals’ injuries or illnesses, but only those directly linked to the specific incident.

How do medical record review services help insurance companies? By utilizing professional medical review solutions, insurance companies can ascertain the severity of injuries or illnesses and their corresponding costs. This thorough examination ensures that insurers only pay for expenses directly attributable to the injury or illness, contributing to a fair and accurate determination of claim amounts.

Benefits of Medical Record Review Services for Insurance Providers

Experienced reviewers and registered nurse consultants providing claims review services clearly understand all the intricate details in the records and ensure that all relevant facts are extracted and presented clearly.

Enhance your insurance operations with our medical record review services!

What Does Medical Record Review Services Involve?

The medical documentation review process begins with the collection of medical records from the insured’s healthcare providers. Trained medical reviewers review the records to determine the extent of the injury or illness and the associated costs. They also consult with the insured’s healthcare providers to obtain additional information or clarification. Once the review is complete, a medical records summary is provided to the insurer, which includes a summary of the insured’s medical condition, the associated costs, and the appropriate course of treatment.

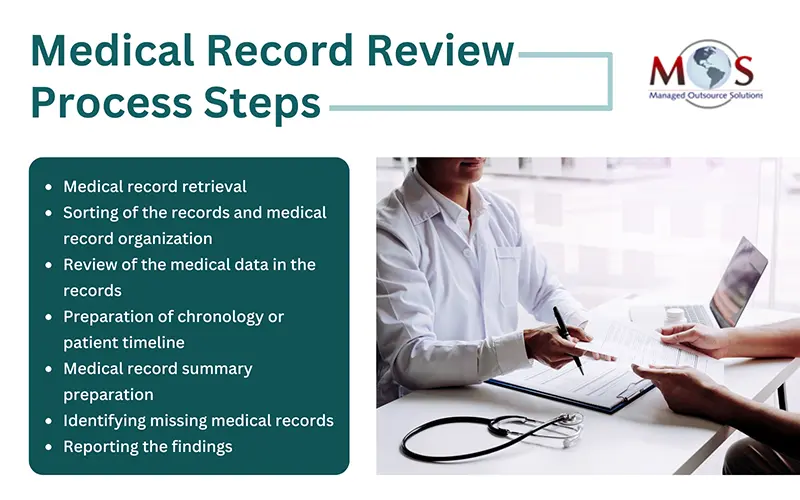

Medical Record Review Process Steps for Insurance Companies

- Requesting and retrieving medical files: Insurance companies or record review service providers seek authorization from the policyholder to access their medical records, ensuring compliance with privacy regulations. Once the authorization is secured, they communicate with healthcare providers and facilities to retrieve the necessary documents, including physician notes, test results, treatment plans. Timely and efficient retrieval is critical to maintaining the flow of the medical record review process.

- Sorting and organizing the records: Once the medical records are collected, the next step is to sort and organize them systematically. This involves categorizing the documents, such as physician notes, test results, and treatment plans, in a manner that facilitates efficient access and reference during the review process. Proper sorting and organization contribute to a streamlined and effective evaluation of the individual’s health history.

- Analyzing and interpreting the data: Once the records are organized, the medical data undergoes a thorough analysis. This step involves a detailed examination of the individual’s health information, identifying key trends, pre-existing conditions, and any potential risk factors. Medical professionals including registered nurses or legal nurse consultants, play a crucial role in interpreting the data to assess its implications.

- Creating an accurate medical chronology/timeline: To enhance clarity and facilitate a comprehensive understanding of the individual’s health journey, insurance companies create a detailed medical chronology or timeline. This visual representation helps to chronologically map out significant events, diagnoses, and treatments, providing a clear overview of the policyholder’s medical history. This chronological presentation aids in making informed decisions.

- Medical record summary preparation: The process involves abstracting details such as case-related relevant symptoms and treatments, creating an accurate report for all identified items such as physical therapy evaluation, radiology report, evaluation/assessment form and so on, categorizing data under sections such as history, complaint, observations, diagnosis, prescriptions, and treatments, creating timelines and charts to show treatments from the relevant period(s) of treatment.

- Identifying missing medical records: The medical record review team would also identify any missing medical records relevant to the case and arrange to secure those at the earliest.

- Reporting the findings: After the review, the medical record reviewers compile their findings into a report. This report typically includes:

- Summary of the case

- Evaluation of the appropriateness of care

- Recommendations for claim approval or denial

The insurance company uses the findings from the report to make informed decisions regarding the claim. This helps to:

- Approve the claim for payment

- Deny the claim based on inadequate documentation or inappropriate care

- Request for additional information if needed

For choosing the right provider of medical review solutions, make sure to consider factors such as the company’s experience and expertise in the field, ensuring they have a proven track record of delivering accurate and thorough medical record analysis. Look for a medical documentation review company equipped with advanced technologies and data security measures to safeguard sensitive information. Also, assess the company’s capacity to handle diverse medical specialties and stay abreast of evolving healthcare standards.

Navigate the complexities of insurance claims with our medical record review services!