People who are unable to work due to a disabling injury or medical condition can opt for individual disability income insurance (IDI) or a group long-term disability (LTD) insurance policy or social security disability insurance (SSDI). When people apply for disability insurance, health plans need to review the claim forms and the entire medical chart. Insurers will conduct a medical record review periodically in order to identify changes that show that the claimant is no longer disabled. During each stage of the process, examination records, test results, and the treating physician’s ongoing evaluation etc. are highly significant. Proper review enables insurers to make a fair decision regarding the claim presented by the disability applicant. Accurate medical chart review is important not only from the point of view of making a fair disability decision, but also to prevent insurance fraud and consequent healthcare costs.

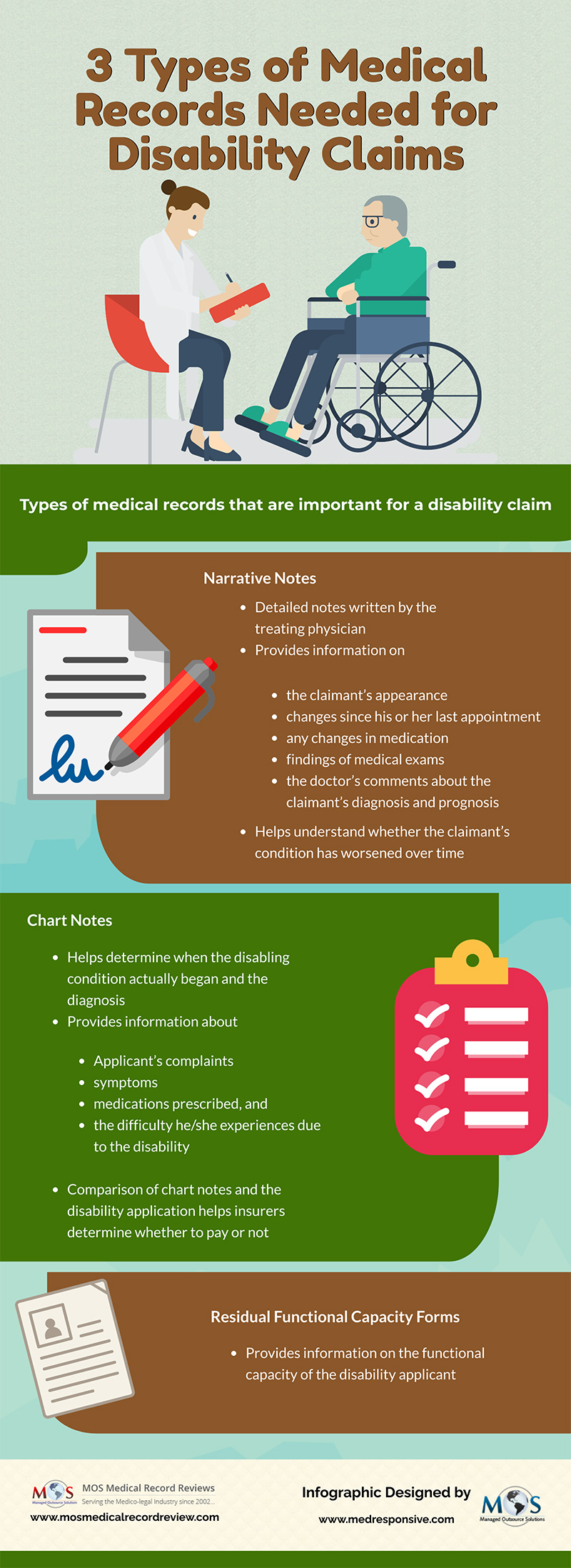

Check out the infographic below

![Exclusive New Year Deal: Enjoy FREE TRIAL + 25% OFF Your First Invoice [Infographic]](https://www.mosmedicalrecordreview.com/wp-content/uploads/2025/01/get-free-trial-plus-25-off-your-first-invoice-400x250.jpg)

![Exclusive Festive Deal: Enjoy FREE TRIAL + 25% OFF Your First Invoice [Infographic]](https://www.mosmedicalrecordreview.com/wp-content/uploads/2024/12/exclusive-festive-deal-enjoy-free-trial-25-off-first-invoice-400x250.jpg)